How to Bill a Client for a Gift Card: Clear Format and Best Practices

When billing clients for gift cards, use a simple, clear invoice format that shows the prepaid amount, gift card details, terms, and payment info. Keep billing separate from product delivery, record revenue correctly, and ensure compliance with local laws.

When billing clients for gift cards, use a simple, clear invoice format that shows the prepaid amount, gift card details, terms, and payment info. Keep billing separate from product delivery, record revenue correctly, and ensure compliance with local laws. Integrate with your POS or billing software to track sales and redemptions smoothly.

1. Understand the Billing and Gift Card Structure

Billing for gift cards is different from regular sales because the client pays upfront for future use — not immediate goods or services. Your invoice should clearly reflect this prepaid nature.

- The gift card amount: The prepaid value (e.g., $100, $250).

- Type of gift card: Physical, digital, rechargeable, or variable value.

- Terms and conditions: Expiration dates, fees, usage limits, and where the card can be redeemed.

- Unique gift card code/ID: A serial number or code that ties the bill to the issued card for tracking.

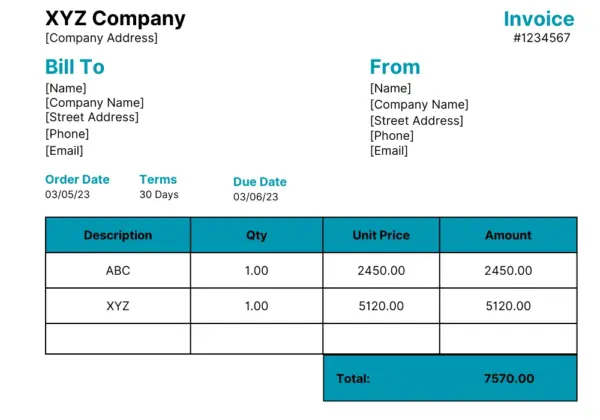

2. Use a Standard Billing Format for Gift Cards

Your gift card invoice should include the following elements to be professional and legally sound:

- Seller information: Business name, address, contact details.

- Client information: Client name and billing address.

- Invoice number and date: For tracking and record‑keeping.

- Description: For example, “Gift Card Sale” or “Prepaid Gift Card” with the card value.

- Gift Card Code/ID: The unique code for tracking the card.

- Amount charged: The prepaid amount on the card.

- Payment terms: Usually “Full payment upfront” or “Due on receipt”.

- Tax details: Include if required by your local regulations (some jurisdictions tax gift card sales at point of sale, others at redemption).

Example Invoice Format

| Description | Gift Card Code | Quantity | Unit Price | Total Amount |

|---|---|---|---|---|

| Prepaid Gift Card $100 | GC-123456789 | 1 | $100.00 | $100.00 |

3. Account for Gift Card Sales and Redemption Separately

Since gift cards are prepaid, proper accounting is essential:

- Record the sale as deferred revenue (a liability) until the card is used.

- Recognize the revenue only when the gift card is redeemed against goods or services.

- Use your POS or billing software to automate this process and reduce errors.

This separation ensures accurate financial reporting and avoids overstating income before the card is actually spent.

4. Integrate with POS or Gift Card Systems

If you use a POS system (like Shopify, Square, or a dedicated gift card platform):

- Enable gift card features to automatically create invoices when cards are bought.

- Send clients their unique gift card codes along with the invoice or receipt.

- Track redemptions clearly within your system (e.g., mark card as “partially used” or “fully redeemed”).

Integration reduces manual work, minimizes errors, and gives you a clear audit trail for each card.

5. Transparency and Compliance

Make sure your billing complies with local rules and builds trust with clients:

- Clearly state gift card expiry dates and any fees on the invoice or a separate terms sheet.

- Follow disclosure rules for prepaid cards in your country/region.

- Present gift card information clearly on invoices to avoid client confusion (e.g., “This is a prepaid gift card, not a product delivery”).

Summary

Using this format helps you bill gift cards clearly, keep correct records, and build trust with clients by being upfront and organized. You can also integrate this with your existing systems to simplify processes.

For additional detail or to stay updated on best practices, check these recent resources:

- Blackhawk Network’s 2025 Gift Card Research Report

- Total Retail on Digital Gift Card Trends

- PaymentsJournal on Gift Card Growth Factors